Can I Use a Prepaid Card for Cash App? Understanding the Ins and Outs

In today’s digital age, mobile payment apps like Cash App have become indispensable tools for managing finances, splitting bills, and sending money to friends and family. A common question that arises, particularly for those without traditional bank accounts, is: Can I use a prepaid card for Cash App? The short answer is often yes, but with certain caveats and limitations. This comprehensive guide will explore the compatibility of prepaid cards with Cash App, the potential benefits and drawbacks, and how to navigate the process effectively.

Understanding Cash App and Its Functionality

Cash App, developed by Block, Inc. (formerly Square, Inc.), is a mobile payment service that allows users to transfer money to one another using a mobile phone app. Users can also receive direct deposits, invest in stocks and Bitcoin, and obtain a debit card linked to their Cash App balance. The app’s versatility has made it a popular choice for a wide range of financial transactions.

Key Features of Cash App

- Peer-to-peer payments: Send and receive money instantly with other Cash App users.

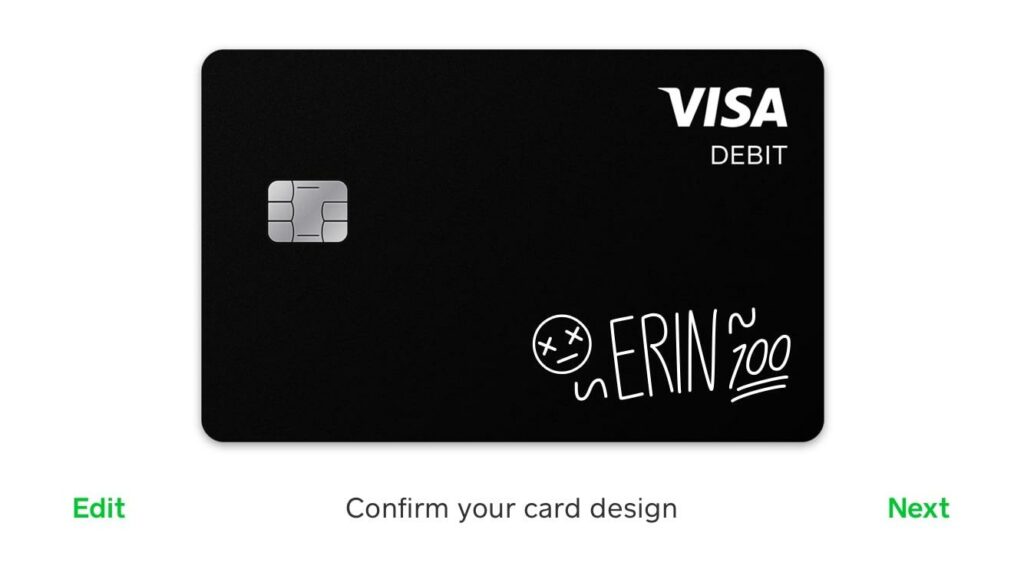

- Cash Card: A customizable Visa debit card linked to your Cash App balance, allowing for purchases online and in stores.

- Direct Deposit: Receive paychecks, tax refunds, and other direct deposits directly into your Cash App account.

- Investing: Buy and sell stocks and Bitcoin directly within the app.

- Cash Boost: Instant discounts at various retailers when using the Cash Card.

Prepaid Cards: A Financial Alternative

Prepaid cards offer a convenient alternative to traditional bank accounts. These cards are loaded with a specific amount of money and can be used for purchases until the balance is depleted. They are often used by individuals who may not have access to a bank account, are looking to manage their spending, or prefer not to use credit cards.

Benefits of Prepaid Cards

- Accessibility: Easy to obtain without a credit check or bank account.

- Budgeting: Helps control spending by limiting the amount available on the card.

- Security: Reduces the risk of overspending or accumulating debt.

- Convenience: Can be used for online and in-store purchases, similar to debit or credit cards.

Compatibility: Can I Use a Prepaid Card for Cash App?

The ability to use a prepaid card with Cash App depends on the specific type of prepaid card and whether it meets Cash App’s requirements. Generally, Cash App accepts most major prepaid cards that are Visa, Mastercard, American Express, or Discover branded. However, the card must be registered in your name and have a valid billing address associated with it.

Steps to Add a Prepaid Card to Cash App

- Open Cash App: Launch the Cash App application on your mobile device.

- Tap the Profile Icon: Click on the profile icon located in the upper-right corner of the screen.

- Select “Linked Banks”: Scroll down and select the “Linked Banks” option.

- Add Bank: Tap “Link Bank.”

- Choose “No Card?”: Select the option that says “No Card?” or “Link with Account Number.”

- Enter Prepaid Card Details: Enter the routing and account number associated with your prepaid card. This information is typically found on the prepaid card’s website or mobile app.

If the prepaid card is successfully linked, you should be able to use it to add funds to your Cash App balance. However, not all prepaid cards are created equal, and some may not be compatible.

Potential Issues and Limitations

While many prepaid cards can be used with Cash App, there are potential issues and limitations to be aware of:

Card Registration

One of the most common hurdles is ensuring that the prepaid card is properly registered in your name with a valid billing address. Cash App requires this information for verification purposes and to prevent fraud. If the card is not registered or the information is inaccurate, Cash App may reject the card.

Card Type

Some prepaid cards, particularly those designed for one-time use or gift cards, may not be compatible with Cash App. These cards often lack the necessary features, such as a permanent account number and billing address, required for verification. Therefore, it’s essential to check the terms and conditions of the prepaid card before attempting to link it to Cash App.

Transaction Limits

Prepaid cards often have transaction limits that can affect your ability to use them with Cash App. These limits may restrict the amount of money you can add to your Cash App balance or the frequency of transactions. Be sure to review the transaction limits associated with your prepaid card to avoid any issues.

Fees

Prepaid cards may come with various fees, such as activation fees, monthly maintenance fees, transaction fees, and ATM withdrawal fees. These fees can eat into your balance and reduce the amount of money available for use on Cash App. It’s important to understand the fee structure of your prepaid card before using it with Cash App.

Verification Issues

Cash App may require additional verification steps when linking a prepaid card, such as providing a copy of your ID or proof of address. This is to ensure the security of your account and prevent fraudulent activity. If you fail to complete the verification process, Cash App may restrict your ability to use the prepaid card.

Troubleshooting Common Problems

If you encounter issues while trying to use a prepaid card with Cash App, here are some troubleshooting tips:

- Verify Card Registration: Ensure that the prepaid card is properly registered in your name with a valid billing address. Contact the prepaid card issuer if you need to update your registration information.

- Check Card Type: Make sure that the prepaid card is not a one-time-use or gift card. Look for prepaid cards that are designed for regular use and have a permanent account number.

- Review Transaction Limits: Check the transaction limits associated with your prepaid card. If you are exceeding the limits, try using a different payment method or contacting the prepaid card issuer to increase the limits.

- Contact Cash App Support: If you are still experiencing issues, contact Cash App support for assistance. They may be able to provide additional guidance or resolve any technical problems.

Alternatives to Using Prepaid Cards with Cash App

If you find that your prepaid card is not compatible with Cash App or you are experiencing too many issues, consider these alternative payment methods:

- Debit Card: Link a debit card from a traditional bank account to Cash App. This is often the easiest and most reliable way to add funds to your Cash App balance.

- Bank Account: Connect your bank account directly to Cash App. This allows you to transfer funds to and from your bank account without using a debit card.

- Cash App Card: Obtain a Cash App Card, which is a customizable Visa debit card linked to your Cash App balance. You can use this card for purchases online and in stores, as well as to withdraw cash from ATMs.

The Future of Prepaid Cards and Mobile Payment Apps

The integration of prepaid cards and mobile payment apps like Cash App is likely to evolve as technology advances and financial services become more accessible. As more prepaid card issuers partner with mobile payment platforms, we can expect to see greater compatibility and functionality. This will provide more options for individuals who prefer to use prepaid cards for their financial transactions.

Moreover, advancements in security and verification technologies will help to reduce the risk of fraud and ensure the safety of prepaid card transactions on mobile payment apps. This will make prepaid cards an even more attractive option for those who are looking for a secure and convenient way to manage their finances.

Conclusion

So, can I use a prepaid card for Cash App? The answer is generally yes, but it depends on the specific prepaid card and whether it meets Cash App’s requirements. While using a prepaid card with Cash App can offer convenience and accessibility, it’s important to be aware of the potential issues and limitations. By understanding the compatibility requirements, troubleshooting common problems, and exploring alternative payment methods, you can effectively navigate the world of prepaid cards and mobile payment apps.

Ultimately, the best payment method for Cash App depends on your individual needs and preferences. Whether you choose to use a prepaid card, debit card, or bank account, Cash App provides a versatile platform for managing your finances and sending money to friends and family. Always ensure you’re using a registered card and aware of any fees or limitations associated with it.

[See also: How to Link a Bank Account to Cash App]

[See also: Cash App vs Venmo: Which is Better?]

[See also: Understanding Cash App Fees and Limits]